Account Types Overview

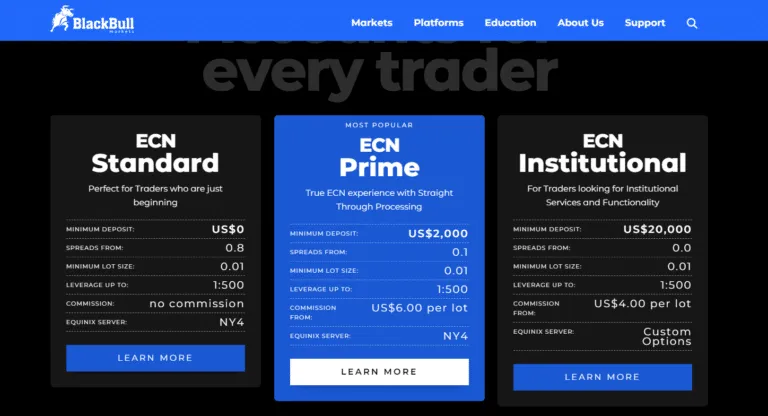

BlackBull Markets structures trading accounts to accommodate different trading styles and capital requirements. The broker offers three primary account categories: Standard, Prime, and Institutional, each with specific trading conditions. Through ECN connectivity, all accounts access institutional-grade liquidity and execution. The platform maintains consistent execution speeds under 75 milliseconds across all account types. Trading conditions scale with account tiers, offering improved spreads and commissions. Account features expand through verification levels and trading volume. Each account type supports the full range of 26,000+ trading instruments.

| Feature | Standard Account | Prime Account | Institutional Account |

| Min. Deposit | $0 | $2,000 | $20,000 |

| Spreads From | 0.8 pips | 0.1 pips | 0.0 pips |

| Commission | $0 | $6/lot | $4/lot |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Execution | ECN | ECN | ECN |

| VPS Hosting | No | Yes | Yes |

| Support | Standard | Priority | Dedicated |

Standard Account Features

The Standard Account provides entry-level access to BlackBull Markets’ trading environment without minimum deposit requirements. Traders access all available platforms including MetaTrader 4, MetaTrader 5, and cTrader. The account operates with commission-free trading and spreads from 0.8 pips. Position sizes range from 0.01 to 100 lots per trade. The platform enables automated trading through Expert Advisors and copy trading systems. Standard accounts maintain full access to educational resources and market analysis tools. Account holders receive standard customer support through multiple channels.

Standard Account Trading Conditions

Key features include:

- Zero commission trading

- Full platform access

- Basic market analysis tools

- Standard support access

- Regular market updates

- Basic account management

- Educational resources

Prime Account Specifications

he Prime Account targets active traders with enhanced trading conditions and support features. A minimum deposit of $2,000 unlocks reduced spreads starting from 0.1 pips. The account includes commission-based trading at $6 per standard lot. Traders receive free VPS hosting for automated trading strategies. The platform provides advanced market analysis tools and priority support access. Prime accounts enable multiple sub-account management through a single interface. Additional features include customizable reporting and enhanced API access.

Institutional Account Benefits

BlackBull Markets designs Institutional Accounts for professional traders and money managers. The account requires a minimum deposit of $20,000 with customizable trading conditions. Spreads start from 0.0 pips with competitive commission structures. Institutional clients receive dedicated support and customized solutions. The platform enables white-label solutions and custom API integration. Advanced reporting tools provide detailed performance analysis. Multiple sub-accounts facilitate client fund management.

| Trading Tools | Standard | Prime | Institutional |

| Analysis Tools | Basic | Advanced | Premium |

| API Access | No | Limited | Full |

| Reports | Daily | Real-time | Custom |

| Indicators | 30+ | 50+ | 100+ |

| Templates | 3 | 10 | Unlimited |

| Automation | Basic | Advanced | Custom |

Islamic Account Options

BlackBull Markets provides swap-free Islamic Accounts compliant with Shariah law. Islamic accounts maintain equivalent trading conditions to standard accounts without overnight fees. The platform offers Islamic variants of Standard and Prime accounts. Position rollovers occur through administrative adjustments rather than interest calculations. Islamic accounts support all trading platforms and instruments. Account holders access the same technical and analytical tools. Islamic account verification requires additional documentation.

Islamic Account Features

Specifications include:

- Swap-free trading

- Standard spreads

- Regular commissions

- Full platform access

- Complete instrument range

- Standard support

- Regular account features

Demo Account Facilities

BlackBull Markets offers demo accounts replicating live trading conditions. Demo accounts provide $100,000 virtual currency for practice trading. The platform enables testing across all available trading instruments. Demo users access all technical analysis tools and indicators. Account validity extends to 30 days with possible extensions. Multiple demo accounts allow testing different strategies simultaneously. The system provides detailed performance tracking for strategy evaluation.

Account Security Measures

BlackBull Markets maintains strict security protocols across all account types. Two-factor authentication protects account access and transactions. Client funds remain segregated in tier-1 banks including ANZ Bank. The platform implements SSL encryption for data transmission and storage. Regular security audits ensure system integrity and compliance. Account monitoring identifies suspicious activities and patterns. Multiple verification layers protect sensitive account operations.

Security Features

Protection includes:

- Two-factor authentication

- SSL encryption

- Fund segregation

- Activity monitoring

- IP tracking

- Session management

- Security alerts

Account Management Features

BlackBull Markets implements comprehensive account management tools across all account types. The platform enables real-time monitoring of positions and account metrics. Multi-account management facilitates operations across different account types. Performance reporting provides detailed trading analysis and statistics. Risk management tools include margin monitors and position sizing calculators. Account settings remain configurable through the secure client portal. The system maintains detailed transaction and trading histories.

| Management Features | Basic Level | Advanced Level | Professional Level |

| Sub-accounts | 2 | 5 | Unlimited |

| Reporting | Standard | Enhanced | Custom |

| Risk Tools | Basic | Advanced | Premium |

| API Integration | No | Yes | Custom |

| Support Access | Email/Chat | Priority | Dedicated |

| Account Monitoring | Basic | Advanced | Real-time |

Account Upgrade Procedures

BlackBull Markets facilitates seamless transitions between account types through structured upgrade processes. Traders submit upgrade requests through the secure client portal. Additional verification may apply for higher account tiers. Account histories and settings transfer to upgraded accounts automatically. The platform maintains trading access during upgrade procedures. Support staff assists with upgrade processes and requirements. Documentation requirements vary by account type and region.

FAQ

Yes, traders can operate multiple account types under a single client profile with separate login credentials.

Open positions remain active during account upgrades, with trading conditions updating upon completion.

No monthly volume requirements exist for account maintenance, though certain features like free VPS require minimum monthly volumes.